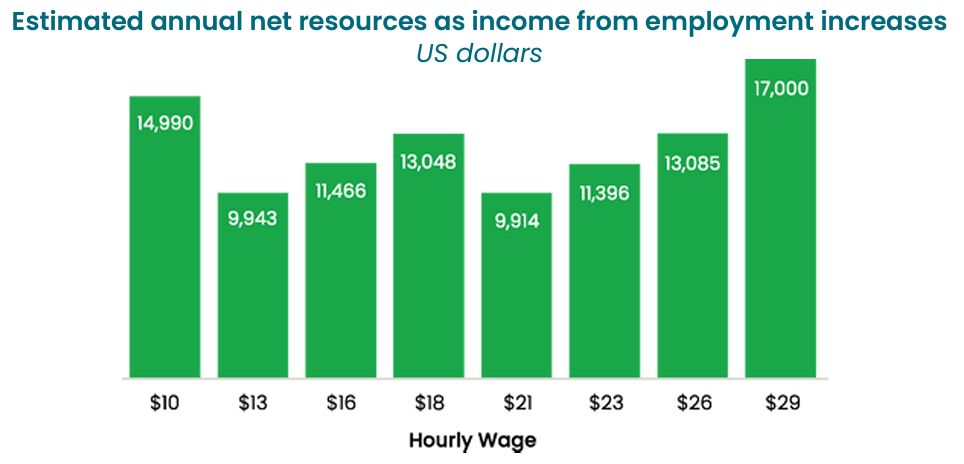

For those earning middle-income or greater salaries, accepting a promotion that comes with a raise is easy math. A bigger paycheck means more margin in the budget. For families living in poverty, however, the math is far more complicated. A $1-$2 per hour wage increase that exceeds the eligibility for government benefits can leave individuals more vulnerable. Career progression can be disincentivized when increases in compensation do not offset the value of the lost government benefits.

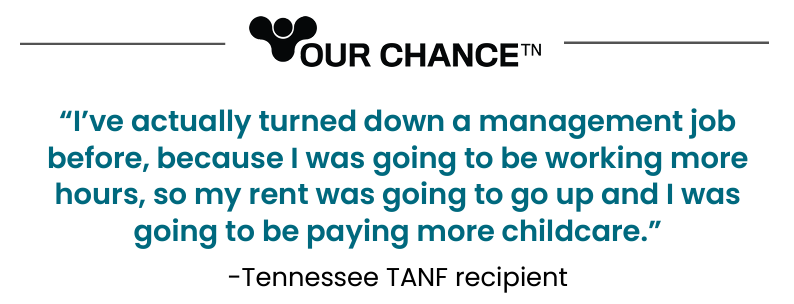

Single parents often face the harshest realities. A single parent with 2 children would need to work nearly 80 hours per week at the Tennessee minimum wage in order to make a living wage. Unfortunately the path to higher wages is not as simple as you might think. As a single parent with 2 children increases their wages beyond $10 per hour, their net resources (combination of their income from work + government benefits) improves only once they start earning $29 per hour. The wage increases between $10 and $29 per hour steadily chip away at their eligibility for SNAP, TANF, childcare, and rent assistance in ways that can leave them financially worse off than before.

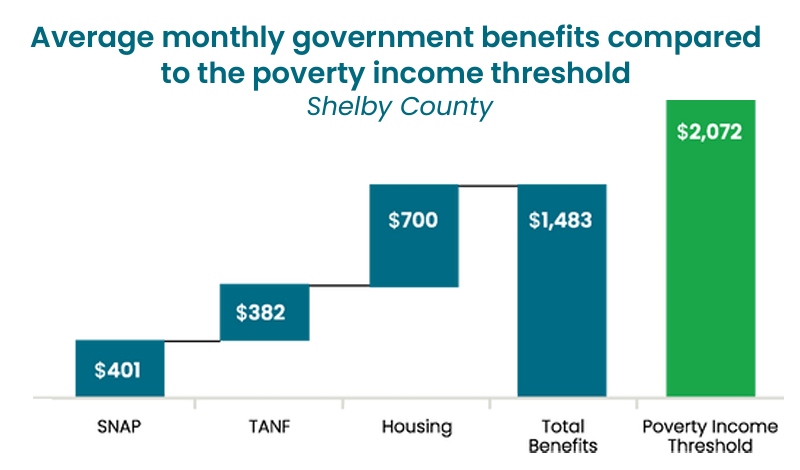

A large proportion of Memphians are at risk of experiencing benefit cliffs. 1 in 5 Shelby County residents participate in the Supplemental Nutrition Assistance Program (SNAP). Shelby County has the largest share of Temporary Assistance for Needy Families (TANF) cases in Tennessee (19 percent, nearly triple the next highest county). Over 25,000 Memphians receive rent assistance. In a survey of Tennessee families who receive TANF support, 85 percent said they had been impacted by the benefits cliff.

Government benefits alone are not enough to live above the poverty line. Commissioner Clarence Carter of the Tennessee Department of Human Services believes the purpose of TANF is to reduce intergenerational dependency on public benefits by increasing self-sufficiency, education, and economic mobility of families with children. To enable pathways for Memphians experiencing poverty to reach living-wage jobs and no longer need government assistance, government assistance policies and corporate compensation practices need to be aligned to help bridge the benefits gap.